A big question we face with a recession in the U.S. is: What will housing prices do?

If you ask an average consumer today what they believe will happen with the housing market in the near future, they will most likely point to the sharp rise in prices and the looming recession as a sure sign that the housing market is about to crash. They usually refer back to the financial crisis circa 2007-2008 when the housing prices had a similar rapid increase and then a subsequent fall.

The two biggest differences we can see between then and now is this: First, the lending practices preceding the 2007-2008 crash were fairly loose to put it mildly. (Just about any Tom, Dick or Harry could walk into a bank and get a loan after the mortgage regulations were loosened during the Clinton administration.) This allowed a lot more people to buy homes who were not the most financially qualified. Those lax policies also made real estate more attractive and more valuable since more people could now buy into it and achieve home ownership. Because of the increased market activity, the value accelerated as the demand exploded and more people wanted to get in before the prices got too high. But, also because of those practices mortgage defaults started to rise fast as well, as those who really didn’t have the means to sustain a mortgage started letting their homes fall into foreclosure. We all know what happened next, the market tanked as a multitude of distressed homes flooded the market. Banking and mortgage regulations also became more restrictive thereafter to put it mildly. Second, we are not currently seeing the number of foreclosures that happened during that time period. Not even remotely close.

One of the main reasons we are seeing accelerated home values in the Sarasota market (and nationally), is because of the increased demand for housing and the anemic level of homes available for people to purchase following the Covid-19 Pandemic. Once the pandemic was behind us the race for housing was on as people wanted new housing for a variety of reasons. Florida in general, more than likely, saw the highest housing demand of all time in the last 2 years. With inventory at historically low levels it was only natural for prices to rise as fast as demand pushed ahead. One of the reasons for such a low inventory and one of the other consequences of the financial crisis and housing crash of 2007-2008 was the lack of new home construction since that time.

In the height of the mid-2000’s housing boom there were approximately on average 10K-12K homes active in the Sarasota market during that time. To put that into perspective I just now pulled the data from our local MLS, and as of today (08/17/2022) in Sarasota there are: 27 – 3 bed 2 bath homes with 2 car garages under $500K available; 8 – 2 bed 2 bath homes with 2 car garages under $500K available; 14 – 3 bed 2 bath condos under $500K available and 60 – 2 bed 2 bath condos under $500K available. We are averaging 32 single family home sale closings per month for the last 90 days. To understand how low our current housing market inventory is you have to look at the “Month’s Supply” calculation. In a healthy and balanced market, we would see around 6 months’ supply of available homes at any given point in time. When the supply trend goes below 6 months it would be considered a Seller’s Market; when the inverse happens, it becomes a Buyer’s Market. Because we are averaging 32 sales per month within the last 3 months and we currently only have 27 3 bed 2 bath homes available you can see how scarce our current housing market inventory is.

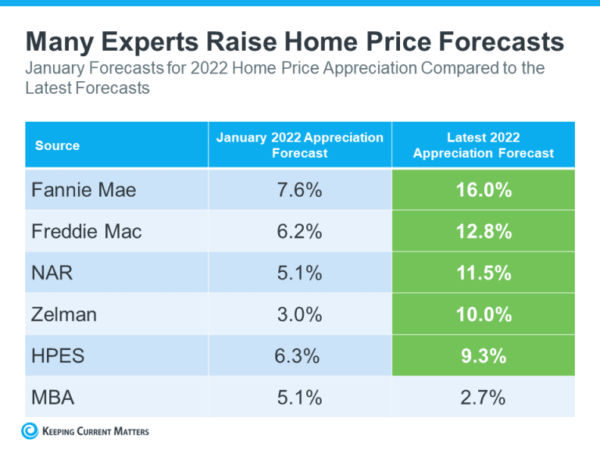

Although the demand has been tamped down a bit by the increased interest rates and recession fears, homes are still selling. Although the inventory is picking up it is still far below a balanced and healthy market. Because of those two indicators in our market it is no wonder economists are still predicting housing prices to continue to rise through 2022 and into 2023.

In June Fed Chairman Jerome Powel said, “It’s still a very tight market. Prices may keep going up for a while, even in a world where rates are up. It’s a complicated situation.”

If you have any questions about buying or selling a home, please don’t hesitate to contact me to discuss further!

***Click Here to read more real estate related articles.***

Contact Form

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.

Published on 2022-08-17 13:38:59